Well being insurance policy is one of the most vital elements of contemporary existence, guaranteeing that men and women and people receive health-related care devoid of dealing with mind-boggling expenses. In the present earth, where healthcare bills can immediately spiral out of control, possessing the proper health and fitness insurance policy methods can offer relief. Well being insurance remedies usually are not just one-dimension-fits-all; they can be found in numerous varieties, catering to distinctive needs and conditions. So, just what are health insurance policies methods, And the way do they gain you? Let’s dive in!

When we look at health insurance plan remedies, we make reference to the array of options available to assistance individuals, family members, or organizations cover their Health care costs. These options can differ significantly dependant upon your preferences, Choices, and spending budget. From traditional ideas offered by companies to specialized insurance policies tailored to precise health wants, knowing the different sorts of health insurance policy might be overwhelming. Having said that, it’s critical to understand these selections, because they Engage in a critical job in preserving your overall health and fiscal perfectly-remaining.

One widespread style of health insurance policy Answer is definitely the employer-sponsored strategy. Lots of businesses offer you well being insurance coverage Gains for their personnel as component in their Total compensation package. These designs typically provide in depth coverage at a decrease Price, as a result of employer contributions. However, not all employer-sponsored strategies are designed equal, and also the protection may range according to the enterprise and the plan picked. Knowledge the small print of your employer’s program is important to ensuring you can get probably the most out of it.

Yet another wellbeing insurance policy Option that Lots of people change to is particular person health insurance policy. Compared with employer-sponsored programs, these procedures are bought directly from an insurance policies service provider, ordinarily by way of federal government exchanges or personal brokers. Personal strategies Supply you with the flexibleness to choose the protection that best fits your personal wellness requires. Irrespective of whether you’re self-utilized, involving Employment, or just favor to handle your health and fitness insurance independently, person health and fitness insurance plan can offer the coverage you would like.

Not known Details About Family Insurance Solutions

For families, wellbeing insurance policy remedies usually incorporate loved ones programs that deal with many loved ones under only one coverage. Family members wellness coverage designs are a well known selection for folks planning to make sure their youngsters get the health-related care they need to have. These plans normally give extensive coverage, which includes schedule check-ups, unexpected emergency care, and hospitalization. Family members programs is usually ordered through companies, governing administration exchanges, or non-public insurance policies corporations, with Each individual alternative featuring various levels of coverage and costs.

For families, wellbeing insurance policy remedies usually incorporate loved ones programs that deal with many loved ones under only one coverage. Family members wellness coverage designs are a well known selection for folks planning to make sure their youngsters get the health-related care they need to have. These plans normally give extensive coverage, which includes schedule check-ups, unexpected emergency care, and hospitalization. Family members programs is usually ordered through companies, governing administration exchanges, or non-public insurance policies corporations, with Each individual alternative featuring various levels of coverage and costs.When considering wellness insurance policy answers, a person crucial factor to keep in mind is definitely the deductible. A deductible is the amount you must pay out-of-pocket before your coverage kicks in. Higher deductibles typically suggest decrease every month premiums, but they also signify you’ll pay back more in the celebration of the clinical emergency. Conversely, decrease deductibles commonly include larger premiums. Finding the ideal harmony among deductible and premium is a vital part of selecting the best health and fitness insurance policies solution for your requirements.

Together with the deductible, A further component to consider may be the network of Medical practitioners and hospitals that your insurance policy strategy covers. Some health insurance programs Possess a constrained network, indicating it's essential to use doctors and amenities that are Section of the community. Other strategies provide a broader network as well as enable you to see any physician you choose, although these plans might have bigger fees. It is really important to make certain that your desired Health care suppliers are included in the approach’s network before committing to a selected wellness insurance policy Remedy.

For the people with unique health and fitness desires, there are specialised wellbeing insurance policy solutions. These programs cater to individuals who have chronic situations, disabilities, or other clinical issues that require specialized treatment. Illustrations consist of options that concentrate on psychological health, cancer care, or diabetic issues administration. These wellbeing insurance coverage remedies can offer far more personalized protection, supporting making sure that people with distinct health problems obtain the treatment options and treatment they need.

5 Easy Facts About Insurance For Families Explained

Wellbeing financial savings accounts (HSAs) are another choice that could enhance your health insurance policies Resolution. HSAs let you put aside pre-tax income to purchase eligible clinical fees. These accounts might be particularly useful In case you have a superior-deductible health strategy, as they help you manage out-of-pocket charges. The money you add to an HSA can roll over year following year, and you can also devote the resources to improve after some time. HSAs supply adaptability and Manage over your Health care shelling out, building them a beneficial addition in your wellness insurance policies Alternative.When trying to find the ideal wellness insurance plan alternatives, it’s essential to Look at various programs and vendors. Well being insurance is not really a one particular-size-matches-all product or service, so it’s critical to find a system that meets your one of a kind wants. Comparing premiums, coverage options, and networks of Health care vendors can help you make an educated determination. A lot of on the net resources and Sites let you Examine diverse options facet by aspect, rendering it See it now easier to find the best choice for you personally.

Yet another vital aspect of wellbeing insurance policies remedies is the concept of preventive care. Numerous wellbeing insurance designs now emphasize preventive treatment, like Find more common Verify-ups, vaccinations, and screenings. Preventive care can help detect health concerns early, cutting down the need for more expensive treatments in a while. Wellness insurance coverage methods that prioritize preventive care can save you funds In the end when advertising and marketing superior Over-all health and fitness.

While overall health insurance policies answers will help cover clinical bills, they also give a feeling of monetary stability. With out well being insurance, even an easy vacation into the physician or an unexpected emergency room visit may lead to significant credit card debt. Wellbeing insurance allows to protect you within the economic stress of sudden professional medical charges, making certain which you could center on getting better as opposed to stressing regarding how to buy treatment.

A single concern Many of us have when choosing a health insurance Alternative is whether they need to choose a plan with a higher premium but extra in depth protection, or perhaps a policy that has a decrease quality but larger out-of-pocket expenses. There’s no straightforward respond to, as the only option is determined by your individual condition. For those who’re in excellent wellness and don’t anticipate many medical expenses, a higher-deductible, very low-quality plan could be a very good solution. Having said that, if you have a history of medical issues or anticipate needing far more Regular treatment, a system with increased rates and lessen out-of-pocket charges is likely to be worth the financial investment.

Unknown Facts About Insurance Solutions For Businesses

Knowledge the cost-sharing facets of wellness coverage solutions is likewise critical. Charge-sharing refers to the portion of medical charges that you simply’re accountable for paying, for example copayments, coinsurance, and deductibles. When assessing distinctive wellbeing insurance policies options, ensure you completely recognize the price-sharing construction And just how it is going to have an impact on your finances. Picking out the right Value-sharing arrangement may also help be sure that your wellness insurance policy approach works for you personally, not in opposition to you.

Given that the healthcare landscape proceeds to evolve, health and fitness insurance policy options are also switching. New alternatives, such as shorter-time period health and fitness designs and telemedicine solutions, are emerging to meet the demands of consumers. Telemedicine, for instance, makes it possible for sufferers to consult with Health care providers remotely, minimizing the need for in-person visits. This may be especially practical for individuals residing in rural parts or People with mobility issues. As extra well being insurance policy organizations give these types of options, They can be reshaping the way in which we think about healthcare.

Occasionally, health and fitness insurance policy answers may possibly involve supplementary ideas to deal with specific requirements. As an illustration, dental and eyesight insurance plan are often offered as separate programs which might be extra to some typical wellbeing insurance policy. These added designs assist address The prices of expert services That will not be included in normal overall health insurance plan, such as dental cleanings or eye examinations. When you’re thinking about a health and fitness insurance policies solution, you should definitely Check out irrespective of whether these supplementary programs can be found and if they in shape into your budget.

Selecting the appropriate well being coverage Answer also necessitates comprehending how the coverage handles out-of-community treatment. Even though in-network care is typically covered at the next charge, out-of-community treatment may well cause larger out-of-pocket prices and even no coverage at all. It’s important to diligently assessment your health insurance policy plan’s guidelines relating to out-of-community care to stay away from any unpleasant surprises.

In summary, acquiring the ideal health coverage Remedy is an important action in safeguarding your health and monetary protection. With lots of options accessible, it could be mind-boggling to pick the finest prepare. On the other hand, by taking into consideration elements which include coverage, rates, networks, plus your particular Health care needs, you may make an informed decision that provides the defense you require. Well being insurance plan Insurance Consultancy is definitely an financial investment with your effectively-staying, and with the appropriate plan, you are able to rest easy figuring out that you've the assist you may need when it matters most.

Elisabeth Shue Then & Now!

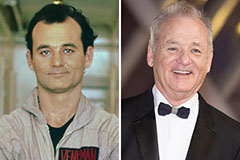

Elisabeth Shue Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Christy Canyon Then & Now!

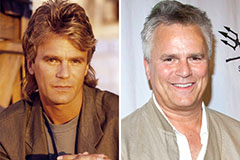

Christy Canyon Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!